One of the biggest concerns of cattle producers meeting last week at the Cattle Industry Convention is the potential negative impact imposing new transfer taxes would have on them.

One of the biggest concerns of cattle producers meeting last week at the Cattle Industry Convention is the potential negative impact imposing new transfer taxes would have on them.

“Everybody’s talking about it being a death tax, but it actually occurs on gifting as well,” said National Cattlemen’s Beef Association (NCBA) Vice President Todd Wilkinson of South Dakota. “If they pay for all this infrastructure on the back of rural America, it’s going to put us out of business.”

Wilkinson says he has never seen a tax proposal that would be so devastating to small business and to the farming and rancher community.

CIC2021 Interview with Todd Wilkinson, NCBA vice president 4:04

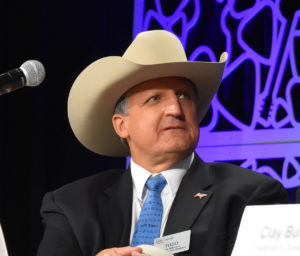

NCBA Policy Division Vice Chair Buck Wehrbein, a cattle feeder from Nebraska, says regulatory and tax issues are always the most important for the industry but the good news is that NCBA representatives are well respected in the nation’s Capitol.

NCBA Policy Division Vice Chair Buck Wehrbein, a cattle feeder from Nebraska, says regulatory and tax issues are always the most important for the industry but the good news is that NCBA representatives are well respected in the nation’s Capitol.

“When we have our legislative conference up there they call it ‘when the hats are in town,'” said Wehrbein. “Legislative issues are going to be tough with this Congress (but) we’ll be working hard to get a different Congress in the next election.”

Wehrbein says tax policies can either “kill us or help us sustain” since one of the legs of the three-legged stool of sustainability is economic.

CIC2021 Interview with Buck Wehrbein, Nebraska 7:38Cattle Industry Convention virtual news room.

2021 Cattle Industry Convention and NCBA Trade Show Photo Album