“Our goal has been for South Dakota producers to have market access to value-added opportunities while protecting property rights on both sides of this issue,” said Scott VanderWal, SDFB president. “We also fought to ensure that affected landowners would be treated fairly and share in profits. Both affected property owners and counties will have an annual amount to apply toward property tax relief or county general funds.”

A $.50 per linear foot annual property tax credit will go to affected landowners. The county tax credit is tied to a claim of the federal tax credit in 45Q by a pipeline company.

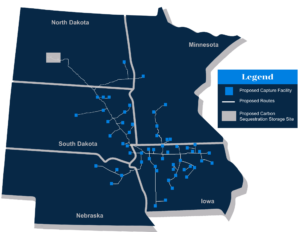

Lee Blank, CEO of Summit Carbon Solutions, called it a win-win scenario for all involved. “We appreciate the attention and engagement from so many South Dakotans, especially our partners and agricultural leaders,” said Blank. “We are excited to have a path forward that establishes best practices we are committed to following in South Dakota and across our entire project.”Blank was on a panel at the recent National Ethanol Conference where he had a very frank discussion with Renewable Fuels Association VP for Strategy and Innovation Tad Hepner about where the pipeline project stands right now. He said that the company has “hardened (its) attitude towards accomplishing this project” in spite of all the set backs and challenges and he admits they made some mistakes at the beginning. “To be fair, I think we deserved a little criticism early…which is the reason I think the original founders of the company decided to take a more agricultural role,” said Blank. “We have made 5800 route changes to this pipe because we do recognize now how that landowner values his acre.”

Listen to some of Blank’s comments on the panel here:

NEC24 Lee Blank, Summit Carbon Solutions, panel comments 9:50