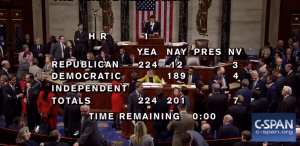

Our House of Representatives again passed the GOP Tax Cuts and Jobs Act, H.R. 1 (115) today after a re-vote. And agriculture is beginning to chime in.

Our House of Representatives again passed the GOP Tax Cuts and Jobs Act, H.R. 1 (115) today after a re-vote. And agriculture is beginning to chime in.

House Agriculture Committee Chairman Mike Conaway (TX-11) praised House passage and said, “Today, Congress has delivered the fairer, simpler tax code that American families and small businesses deserve. This historic tax relief package both simplifies our broken system and sets the economy on a course to stimulate growth and create jobs. As chairman of the House Agriculture Committee, I’m pleased that Chairman Brady and his team have produced a bill that acknowledges the unique tax challenges faced by those in agriculture. From lower marginal rates to the treatment of pass-through income to improved small business expensing, this bill delivers for farmers, ranchers and all rural America.”

U.S. Secretary of Agriculture Sonny Perdue today said, “This is a once-in-a-generation reform of the federal tax code and it comes just in time to be an eagerly awaited Christmas present for taxpayers. Having traveled through our nation’s heartland for most of this year, I know that the hard-working, tax-paying people of American agriculture need relief. Most family farms are run as small businesses, and they should be able to keep more of what they earn to reinvest in their operations and take care of their families. Simplifying the tax code and easing the burden on citizens will free them up to make choices for themselves, create jobs, and boost the overall American economy. I thank President Trump for his leadership, and commend Congress for being responsive to the people.”

The National Cattlemen’s Beef Association’s (NCBA) Beltway Beef podcast was also centered around this hot topic impacting agriculture. Listen to NCBA’s Director of Government Affairs Danielle Beck discuss it’s impact on U.S. cattlemen and women.Beltway Beef with Danielle Beck