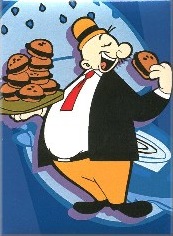

Alright burger lovers. You’re not alone, not by a long shot. Don’t let anyone make you feel guilty about eating one of life’s best food choices. I think burgers should be in their own food group category. And don’t forget that famous line from Wimpy (Popeye), “I’ll gladly pay you Tuesday for a hamburger today.” You can find your very own Wimpy burger magnet online.

Alright burger lovers. You’re not alone, not by a long shot. Don’t let anyone make you feel guilty about eating one of life’s best food choices. I think burgers should be in their own food group category. And don’t forget that famous line from Wimpy (Popeye), “I’ll gladly pay you Tuesday for a hamburger today.” You can find your very own Wimpy burger magnet online.

New research from foodservice consultancy Technomic found that nearly everyone enjoys burgers from time to time. In a recent survey of 1,200 U.S. consumers, the vast majority (85 percent) said they eat burgers once a month or more; only 6 percent say they never eat burgers.

New research from foodservice consultancy Technomic found that nearly everyone enjoys burgers from time to time. In a recent survey of 1,200 U.S. consumers, the vast majority (85 percent) said they eat burgers once a month or more; only 6 percent say they never eat burgers.

These and numerous other findings are detailed in two new reports from Technomic—one that examines key consumer trends in burger consumption, and another that takes a closer look at the Top-25 chain operators in the burger segment. While limited-service chains dominate the burger category, the research confirmed that consumers tend to go to these venues when value, price, portability and speed of service are most important. When purchasing full-service burgers, however, variety and freshness are of greater concern.

Among the more interesting findings in the two burger reports:

- Significant differences were found in burger preferences and consumption behavior based on gender, age, region, ethnicity, and income. For example, Northeastern consumers are the lightest burger users, and Asian consumers are more likely to find themed burgers appealing than other ethnic groups.

- Heavy burger users, those who eat burgers once a week or more, make up the largest burger user category (44 percent); this group skews toward young consumers and those in the South and Midwest.

- While “traditional” burgers still hold solid appeal, there is strong preference toward customization and “build your own burger” options. Additionally, variation in burger size is appealing to consumers, especially miniature burgers, typically sold as appetizers.

- The dynamic burger category continues to be dominated by limited-service restaurants, which represent 33 percent of U.S. LSR sales. Within the nearly-$59 billion burger category, the Top 25 limited-service burger chains held roughly 97 percent of the market—and the Top 3 (McDonald’s, Burger King and Wendy’s) accounted for nearly 75 percent of LSR burger chain sales.

- Sales growth among the Top 25 LSR burger chains presented an extremely varied story, with some chains exhibiting astonishing growth, while others witnessed declines over their prior-year sales.