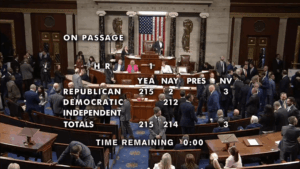

President Donald Trump’s “One Big, Beautiful Bill” passed in the U.S. House of Representatives Thursday morning on a vote of 215-214, with all Democrats and two Republicans voting against. Agricultural organizations are pleased with several of the bill’s provisions.

President Donald Trump’s “One Big, Beautiful Bill” passed in the U.S. House of Representatives Thursday morning on a vote of 215-214, with all Democrats and two Republicans voting against. Agricultural organizations are pleased with several of the bill’s provisions.

American Farm Bureau Federation President Zippy Duvall says the bill “modernizes farm bill programs and extends and improves critical tax provisions that benefit America’s small farmers and ranchers. Updated reference prices will provide more certainty for farmers struggling through tough economic times. Making business tax deductions permanent and continuing current estate tax exemptions will ensure thousands of families will be able to pass their farms to the next generation.”

National Cattlemen’s Beef Association (NCBA) President and Nebraska cattleman Buck Wehrbein says they are pleased that the bill includes key cattle health, disaster recovery, and tax priorities crucial to the success of America’s cattle farmers and ranchers.

“Cattle farmers and ranchers need Congress to invest in cattle health, strengthen our resources against foreign animal disease, support producers recovering from disasters or depredation, and pass tax relief that protects family farms and ranches for future generations,” said NCBA President and Nebraska cattleman Buck Wehrbein. “Thankfully, this reconciliation bill includes all these key priorities. NCBA was proud to help pass this bill in the House and we will continue pushing for these key policies until the bill is signed into law.”

The bill includes an increase to the estate and gift tax exemption amounts to $15 million per individual and $30 million per couple, adjusted for inflation annually and makes this exemption permanent.

Other provisions include a permanent increase to the Section 199A Small Business deduction from 20% to 23%, expanding the limitation on Section 179 from $1 million to $2.5 million, reinstating the 100% bonus depreciation for five years and extending the Federal Disaster Tax Relief Act of 2023.

The bill now goes to the Senate where changes are anticipated.